Vermont collects a tax on the transfer of a Vermont estate of resident and nonresident deceased persons. Generally Vermont Form EST-191 Estate Tax Return must be filed if the deceased person has an interest in property located in Vermont and either 1 their federal gross estate plus federal adjusted taxable gifts made within two years of their death is worth more.

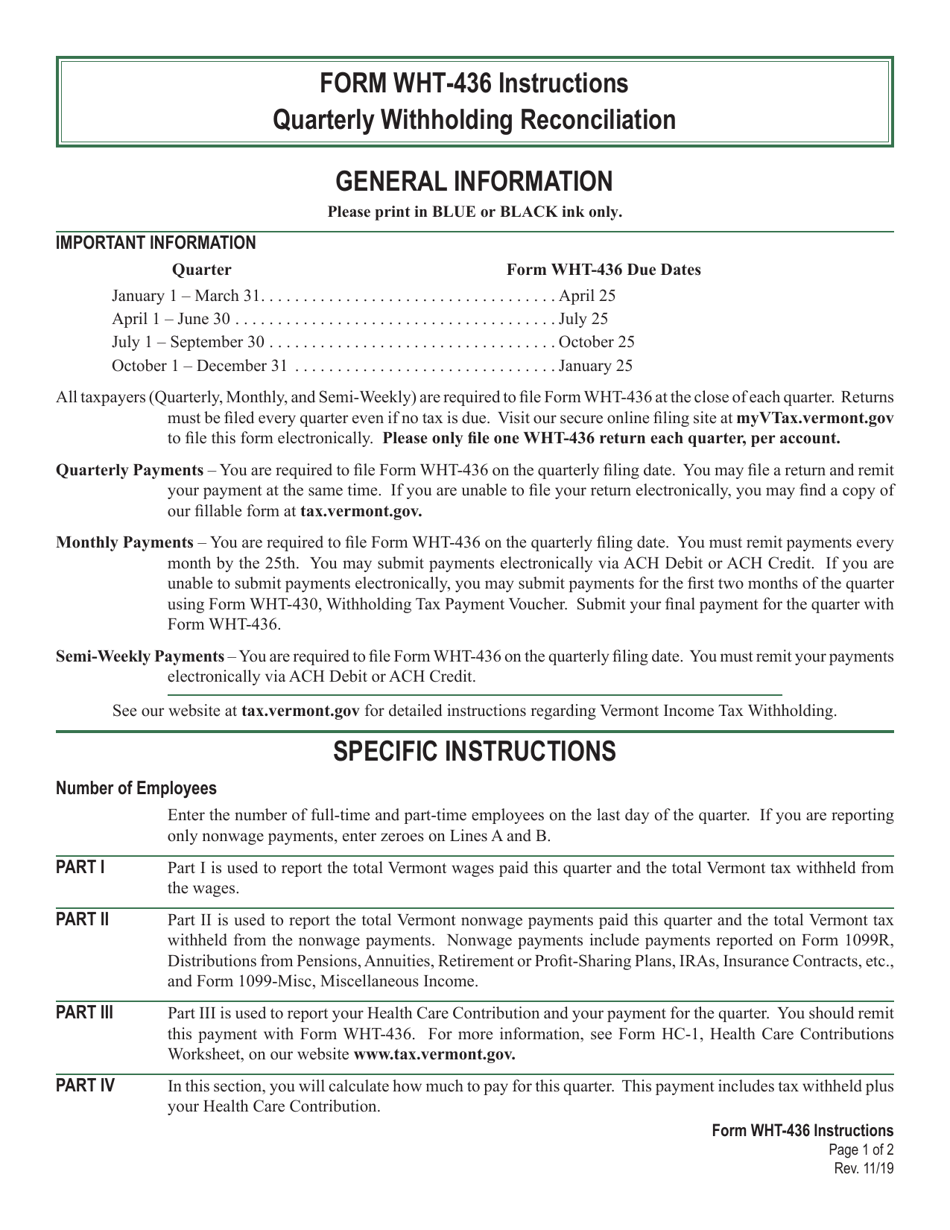

Download Instructions For Vt Form Wht 436 Quarterly Withholding Reconciliation And Health Care Contribution Pdf Templateroller

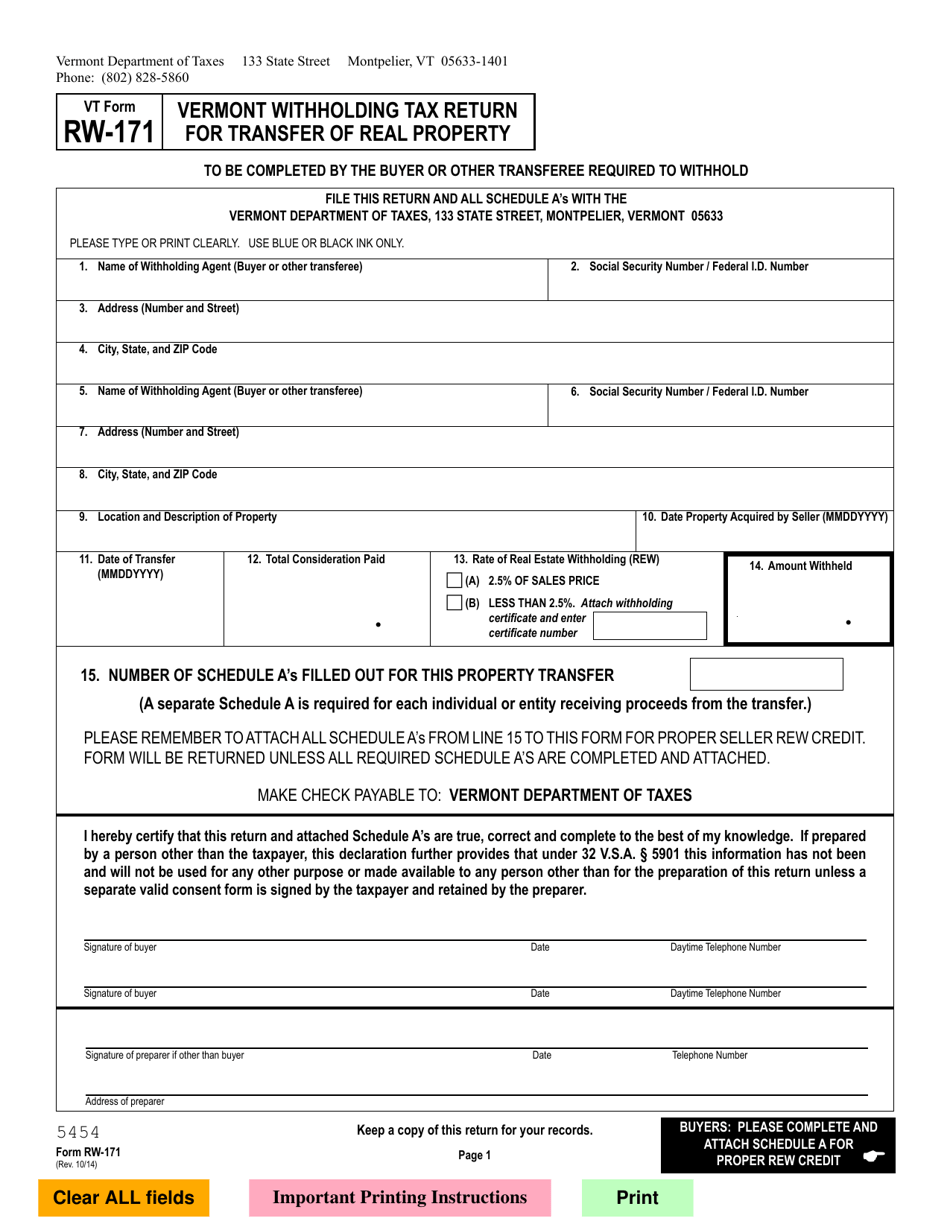

If the seller is a nonresident the buyer is required to withhold 25 of the sale price and remit it to the Vermont Department of Taxes.

. When real estate is sold in Vermont state income tax is due on the gain from the sale whether the seller is a resident part-year resident or nonresident.

Nr4 Non Resident Tax Withholding Remitting

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

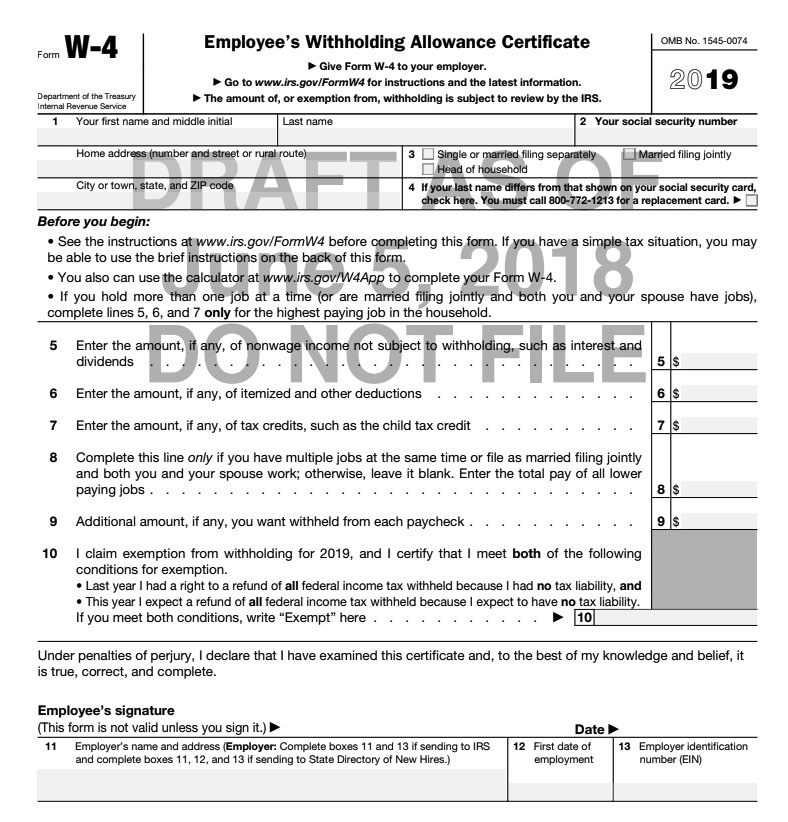

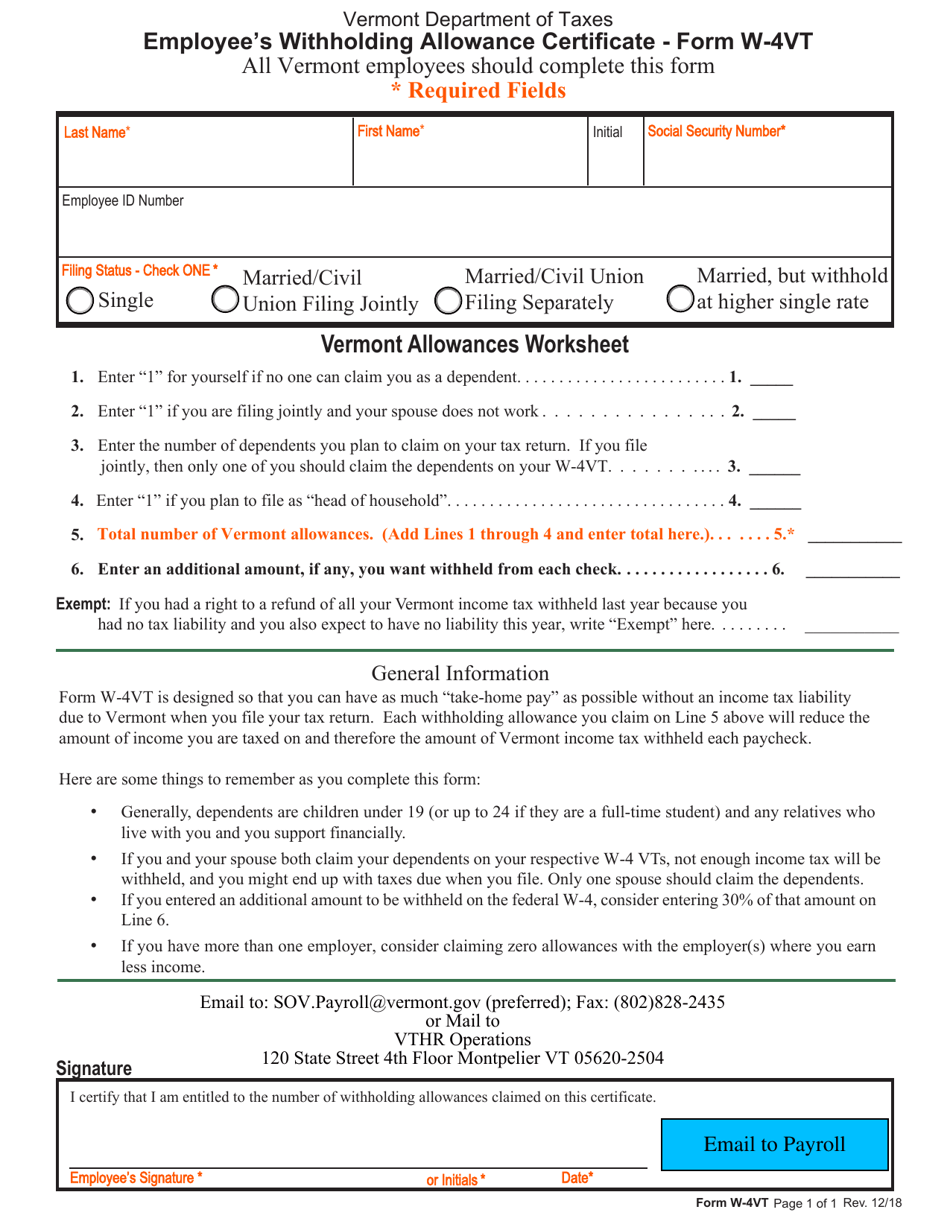

Vt Form W 4vt Download Fillable Pdf Or Fill Online Employee S Withholding Allowance Certificate Vermont Templateroller

State W 4 Form Detailed Withholding Forms By State Chart

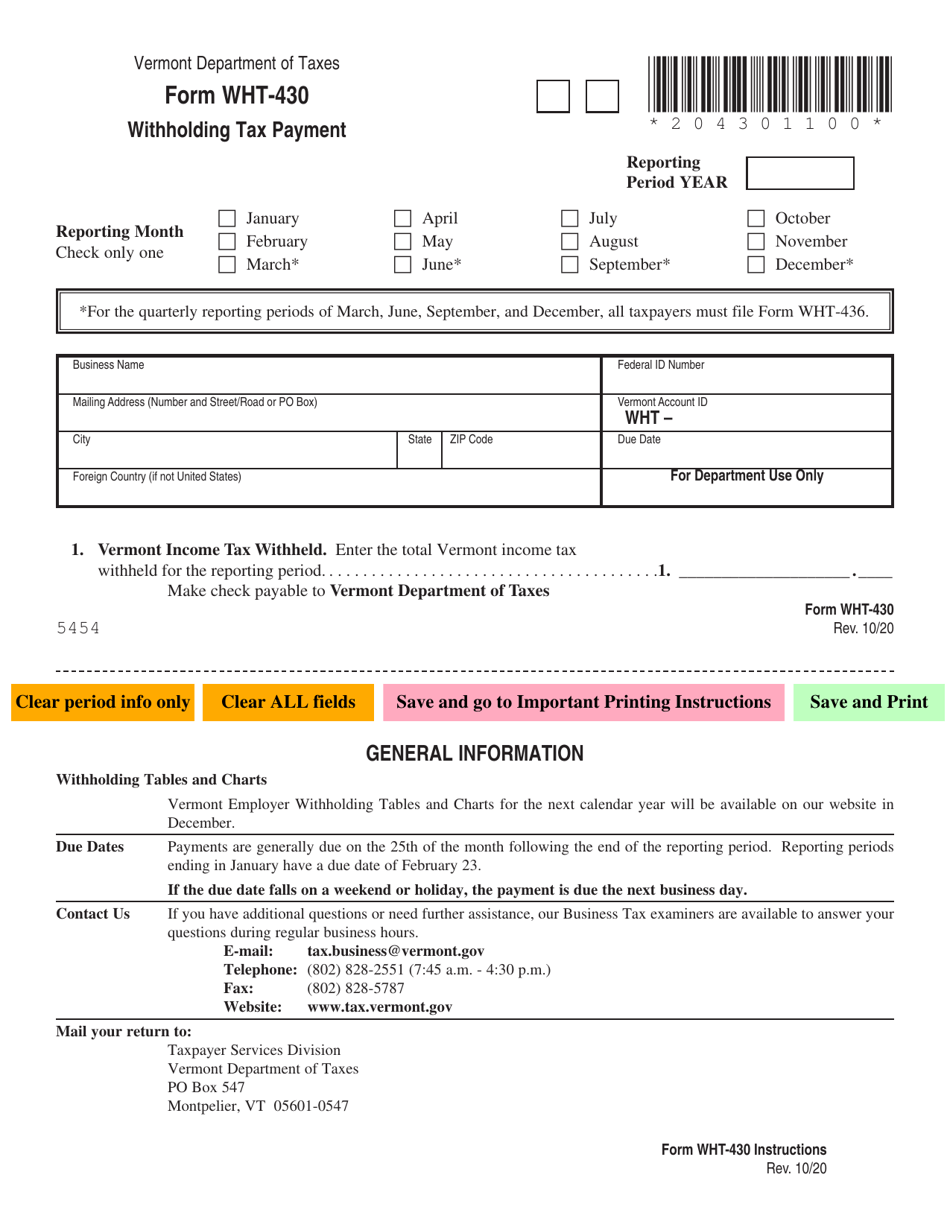

Vt Form Wht 430 Download Fillable Pdf Or Fill Online Withholding Tax Payment Vermont Templateroller

2019 Withholding Tables H R Block

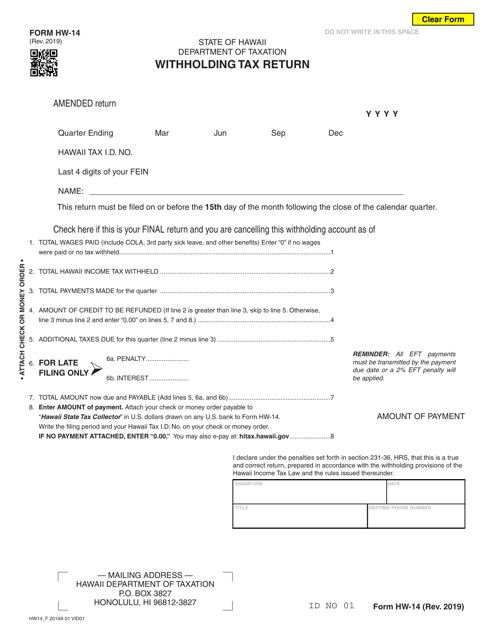

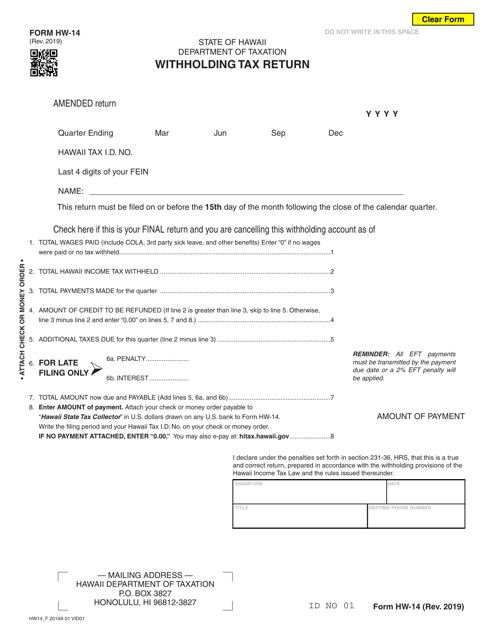

Form Hw 14 Download Fillable Pdf Or Fill Online Withholding Tax Return Hawaii Templateroller

State W 4 Form Detailed Withholding Forms By State Chart

How To Avoid The 30 Tax Withholding For Non Us Self Publishers Thinkmaverick Psychology Books Technology Life Book Publishing

Irs Form 945 How To Fill Out Irs Form 945 Gusto

Paycheck Taxes Federal State Local Withholding H R Block

Vt Form Rw 171 Download Fillable Pdf Or Fill Online Vermont Withholding Tax Return For Transfer Of Real Property Vermont Templateroller